Planning Perspectives

A look at life and finance from every angle.

From personal to professional, from family to financial, there are many facets to your life. Yet, each is interconnected. Planning Perspectives is a source of ideas and information to help you make the most of them all, all together.

2016 Federal Budget Highlights

On March 22, 2016, Federal Finance Minister Bill Morneau tabled the much anticipated first federal budget from the Liberal Party. The minister forecasts a $5.4 billion deficit for the current fiscal year. The current budget projects a $29.4 billion deficit for the fiscal year ended 2017. Below, we highlight the income tax changes that affect individuals and businesses resident in Canada.

INDIVIDUALS

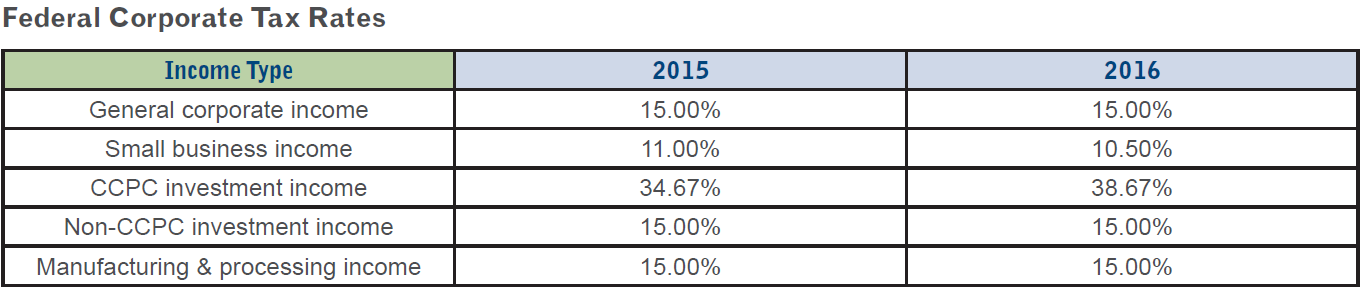

The budget did not make any further modifications to previous announcements in December 2015 which reduced the federal tax rate of 22% on middle income earners to 20.5%. A new federal bracket for income greater than $200,000 to be subject to a rate of 33% was also introduced at that time. The new tax rates and brackets will take effect on January 1, 2016 and are contained in Bill C-2. The income brackets will continue to be indexed to inflation each year.

Federal Personal Income Tax Brackets

Improving Quality of Life for Seniors

The Old Age Security (OAS) and Guaranteed Income Supplement (GIS) eligibility age was scheduled to increase from age 65 to age 67 over the 2023 to 2029 period. The budget proposes to restore the OAS and GIS eligibility back to age 65. Starting in July 2016, the budget proposes to increase the GIS top-up benefit by up to $947 annually. Single seniors with an annual income (other than OAS and GIS benefits) of about $4,600 or less will receive the full increase of $947. Above this threshold, the benefit will be gradually reduced and fully phased out at an income level of about $8,400. Allowance benefits will also now be determined on an individual income basis for senior couples forced to live apart.

In an effort to ensure seniors’ benefits keep pace with actual costs of living, the government is looking at how a new Seniors Price Index could be developed.

Elimination of the Family Tax Cut The budget proposes to eliminate the Family Tax Cut credit effective for the 2016 tax year. The credit equaled tax savings of up to $2,000 per year by allowing couples with a child under age 18 to notionally transfer up to $50,000 of income between spouses.

TIP: Ensure you take advantage of the last available Family Tax Cut credit when filing your 2015 individual income tax returns this year.

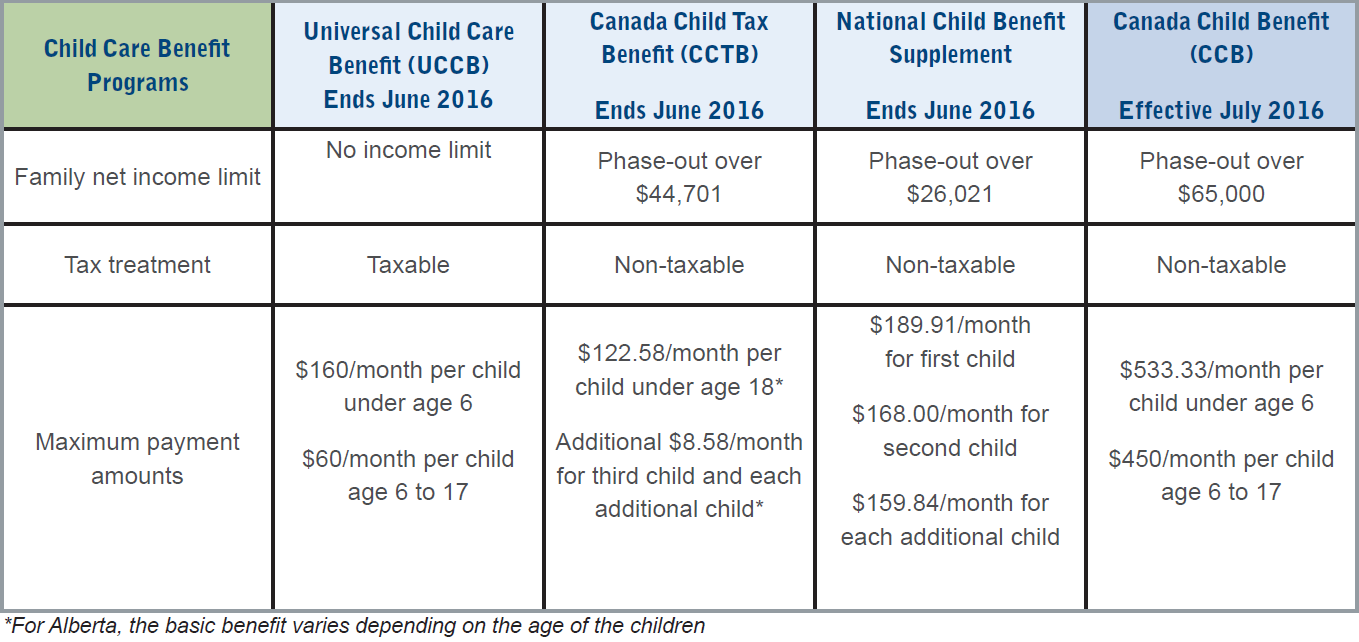

Introduction of New Canada Child Benefit

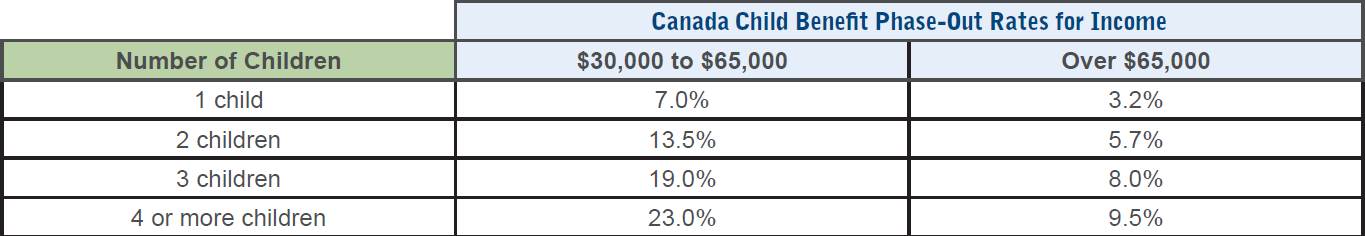

In order to simplify the process and target families that need child benefits the most, the budget eliminates the existing Universal Child Care Benefit program and the Canada Child Tax Benefit. The budget replaces these programs with the new Canada Child Benefit program which will increase benefits to low- and middle-income families and reduce benefits to higher income families. A family with less than $30,000 of net income will receive the maximum amounts of $6,400 per child under the age of 6 and $5,400 per child aged 6 to 17. The benefit will be phased out where family income falls between $30,000 and $65,000 and phased out at an additional rate where income exceeds $65,000. The new amounts will be paid monthly effective starting

July 2016.

The budget also proposes to provide an additional annual amount of $2,730 per child eligible for the Disability Tax Credit. The phase-out of this amount will align with the Canada Child Benefit.

Entitlement to the new CCB for the July 2016 to June 2017 benefit year will be based on adjusted family net income for the 2015 taxation year.

The budget also aligns the retroactive claim of child benefits to a limit of ten calendar years to be consistent with retroactive claims of other tax credits. This measure is effective for requests made after June 2016.

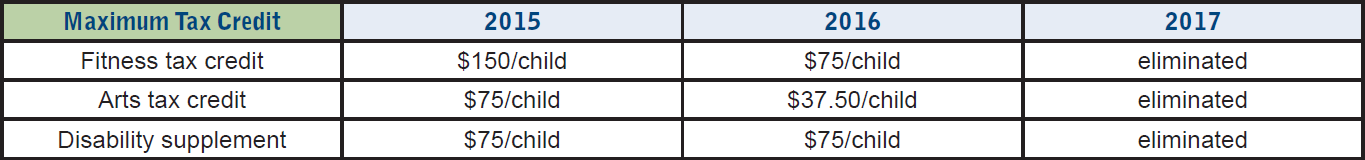

Elimination of the Children’s Arts and Fitness Tax Credits

The budget proposes to reduce the maximum eligible fitness expenses from $1,000 to $500 and arts expenses from $500 to $250 effective for the 2016 tax year. Both credits will be eliminated as of 2017.

Elimination of Education and Textbook Tax Credits

The budget proposes to eliminate both the non-refundable education tax credit ($60/month maximum credit) and the textbook credit ($9.75/month maximum credit). These credits currently enhance the tuition tax credit which is not being eliminated. This measure is effective January 1, 2017. Unused education and textbook amounts carried forward from prior years will remain available to be claimed in 2017 and subsequent years.

The tax exemption for scholarship and bursary income is currently tied to eligibility for the education credit. Tax provisions will be amended to ensure the elimination of the education credit will not affect entitlement to education related income tax exemptions.

Taxation of Switch Fund Shares

Under the Income Tax Act, corporate class mutual fund shares have allowed investors to switch their investment exposure within the same mutual fund corporation without recognizing a disposition for tax purposes. The budget proposes to amend the Income Tax Act so that an exchange of shares of a mutual fund corporation or investment corporation that results in the investor switching between funds will be a disposition for tax purposes for proceeds equal to fair market value. This measure will apply to dispositions that occur after September 30, 2016.

For further clarification, this measure will not apply where the investor is switching from one fee series to another within the same class where the investment derives its value from the same portfolio or fund within the mutual fund corporation.

Sales of Linked Notes

The return on a market linked principal-protected note or principal-at-risk note is considered interest income for tax purposes. As prescribed debt obligations, interest is deemed to accrue on the linked notes annually, however as the return is not known until maturity, investors generally include the interest income amount in the year of maturity. Some investors sell the notes before maturity and take the position that the increase in value is a capital gain. The budget proposes to treat the return as deemed interest at the time of disposition whether the note was held to maturity or sold on the market. When a linked note is denominated in a foreign currency, currency fluctuations will be ignored for the purposes of calculating the interest. If a portion of the return is based on a fixed rate of interest, any portion of the gain that is reasonably attributable to market interest rate fluctuations will be excluded. This measure will apply to sales of linked notes that occur after September 30, 2016.

Mineral Exploration Tax Credit

The budget proposes to extend the mineral exploration tax credit for one year, to flow-through share agreements entered into on or before March 31, 2017. The federal credit is equal to 15% of specified mineral exploration expenses incurred in Canada and renounced to flow-through share investors.

Enhancements to Northern Residents Deduction

Individuals living in prescribed areas of northern Canada for at least six consecutive months may claim a northern residents deduction. The budget proposes to increase the Northern Zone maximum deduction to $11 from $8.25 per day. The household maximum will also increase to $22 from $16.50 per day where no other member of a household claims the residency deduction. Residents of the Intermediate Zone will continue to be entitled to deduct half of the new amounts.

New School Supply Tax Credit

To provide recognition for teachers and early childhood educators who pay for classroom supplies out of their own pocket, the budget introduces a school supply tax credit. The non-refundable credit is equal to 15% of up to $1,000 in eligible supply expenditures made by an eligible employee educator. Educators will have to certify the supplies were used in a learning environment and must retain their receipts for verification. This measure will apply to supplies acquired on or after January 1, 2016.

Labour-Sponsored Venture Capital Corporations Tax Credit (LSVCC)

The LSVCC tax credit was scheduled to be eliminated for the 2017 and subsequent years. In order to support provinces that use their own LSVCC programs to facilitate access to venture capital, the budget proposes to restore the federal LSVCC tax credit to 15% (previously 5% for 2016) for share purchases of provincially registered LSVCCs prescribed under the Income Tax Act, effective for the 2016 and subsequent tax years. However, federally registered LSVCCs will only be eligible for the 5% tax credit for 2016 and it will be eliminated in 2017.

Ontario Electricity Support Program (OESP)

OESP credits are generally required to be included as income and then an offsetting deduction is applied to the amount so it is effectively non-taxable. However, the income inclusion may affect certain income-tested federal and provincial benefits. The budget proposes to exempt OESP credits from income for the 2016 and subsequent taxation years.

Consequential Changes

The introduction of a new top personal tax of 33% affects many other tax calculations which use the top tax rate. Income tax calculations significantly affected by this change were announced December 2015. The government conducted reviews of the Income Tax Act to determine further amendments were required to

these provisions:

•provide a 33% charitable donation tax credit (on donations above $200) to trusts that are subject to the 33% rate on all of their taxable income;

•apply the new 33% top rate on excess employee profit sharing plan contributions;

•increase from 28% to 33% the tax rate on personal services business income earned by corporations;

•amend the definition of “relevant tax factor” in the foreign affiliate rules to reduce the relevant tax factor from the current 2.2 to 1.9;

•amend the capital gains refund mechanism for mutual fund trusts to reflect the new 33% top rate in the formulas that are used in computing refundable tax;

•increase the Part XII.2 tax rate on the distributed income of certain trusts from 36% to 40%; and

•amend the recovery tax rule for qualified disability trusts to refer to the new 33% top rate.

Donations of Private Company Shares and Real Estate

The budget confirms the government does not intend to proceed with the capital gains exemption proposal announced in Budget 2015 by the previous government. The proposal provided an exemption from capital gains tax on dispositions of private corporation shares or real estate where cash proceeds are donated to a registered charity within 30 days of disposition.

The government intends to proceed with all other outstanding tax measures that were not passed into legislation before the election.

BUSINESSES

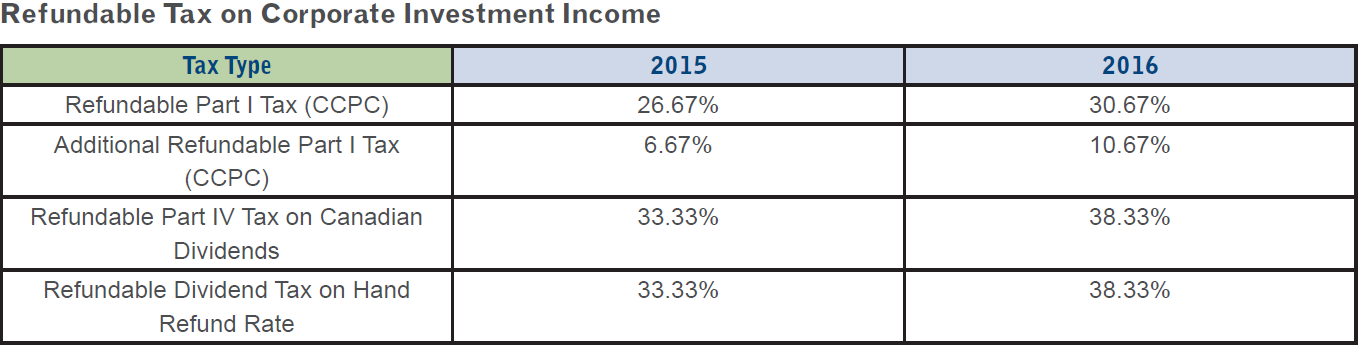

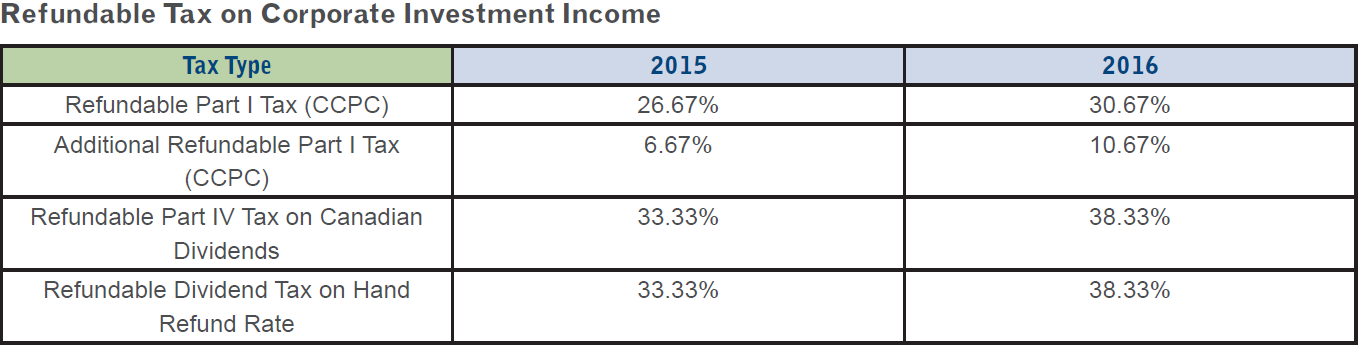

The budget does not retain the previous government’s schedule to reduce small business income tax to 9% in 2019. The rate will remain at 10.5% for current and future years, and the gross-up rate on non-eligible dividends will remain at 17%. The small business income threshold remains at $500,000. The December 2015 announcements increased the tax rates on investment income and the refundable tax rates. These changes were included in Bill C-2.

Preventing Multiplication of the Small Business Deduction (SBD)

The budget proposes to close a loophole in the ability of a CCPC to claim the small business deduction where the shareholder of a corporation is a direct member of a partnership that contracts services to the shareholder’s corporation. These structures had been created to circumvent the existing rules that prevent the multiplication of the small business rate. The budget proposes to deem the CCPC a partner of the partnership which would now only allow the sharing of one SBD amongst corporations not dealing at arm’s length with the individual partners. This measure will apply to taxation years beginning on or after March 22, 2016.

Multiplication can also occur if a CCPC earns active business income from providing services or property to a private corporation and a CCPC shareholder is not dealing at arm’s length with a shareholder of the private corporation. The budget proposes to deny the SBD to the CCPC providing services to the other private corporation where one of its shareholders or a person who does not deal at arm’s length with such a shareholder has a direct or indirect interest in the private corporation. The ineligibility for the SBD will not apply to a CCPC if all or substantially all of its active business income for the taxation year is earned from providing services or property to arm’s length persons other than the private corporation. The CCPC will be entitled to assign all or a portion of its unused business limit to one or more CCPCs that are ineligible for the SBD under this proposal because they provided services or property to the private corporation. This measure will apply to taxation years beginning on or after March 22, 2016.

Avoidance of Business Limit and Taxable Capital Limit

The budget proposes to change legislation affecting associated corporations that claim the small business deduction on investment income that traces to active business income of a third corporation that elects not to be associated with the other corporations. The investment income derived from an associated corporation’s active business will be ineligible for the small business deduction where the exception to the deemed associated corporation rule applies (i.e., an election not to be associated is made or the third corporation is not a CCPC). In addition, where this exception applies, the third corporation will continue to be associated with each of the other corporations for the purpose of applying the $15 million taxable capital limit. This measure will apply to taxation years that begin on or after March 22, 2016.

Consultation on Active Versus Passive Investment Business

The previous budget announced a consultation and review of the circumstances in which income from a business, the principal purpose of which is to earn income from property, should qualify as active or passive income. The consultation closed on August 31, 2015 and the current government is not proposing any modifications to these rules at this time. The “more than five full-time employees” rule for a business that would otherwise be a “specified investment business” still remains intact to deem the property income as active business income, and therefore eligible for the small business deduction.

Life Insurance Distributions

The budget proposes to limit an artificial increase in a corporation’s capital dividend account where a life insurance benefit is paid to the corporation. The same limit would apply to the artificial increase in the adjusted cost base of a partner’s interest in a partnership from a life insurance benefit. Under this measure, the insurance benefit limit applies regardless of whether the corporation or partnership that receives the policy benefit is a policyholder of the policy. Information reporting requirements will apply where a corporation or partnership is not a policyholder but is entitled to receive a policy benefit. This measure will apply to policy benefits received as a result of a death that occurs on or after March 22, 2016.

Transfers of Life Insurance Policies

The budget proposes to include the fair market value of any consideration given for an interest in a life insurance policy in the policyholder’s proceeds of disposition and the acquiring person’s cost when disposing of an interest to a non-arm’s length person. Where the disposition arises on a contribution of capital to a corporation or partnership, any resulting increase in paid-up capital in the corporation and the adjusted cost base of the partnership interest will be limited to the amount of the proceeds of disposition. This measure will apply to policy dispositions that occur on or after March 22, 2016.

Furthermore, the budget proposes to reduce the inclusion for the excess consideration (the value of the policy in excess of the cash surrender value at the time of the transfer) from the capital dividend account for private corporations and adjusted cost base for partnerships for dispositions of life insurance policies before March 22, 2016. Any increase in paid-up capital or adjusted cost base of a partnership interest will be limited to the proceeds of disposition. This measure will apply for policies under which policy benefits are received as a result of deaths that occur on or after March 22, 2016.

This has been prepared by the Wealth Management Solutions Group of Raymond James Ltd., (RJL). Statistics and factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities nor is it meant to replace legal, accounting, taxation or other professional advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The information is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. This is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., Member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a Member-Canadian Investor Protection Fund